What is marine insurance? That's what many people might ask. And in this article, we will take a look at the world of marine insurance and how it can help you protect your boat or your business against all types of damages. It's time to start thinking about marine insurance. But what is marine insurance, and why should you have it? Where can you find more information about buying and financing such a policy? And how does it really help protect you in case of an accident or damage on the water? This article will guide you through these questions and give you help in making your choice.

What is marine insurance?

Marine insurance is a form of insurance that protects

against loss or damage to your vessel and its cargo. It's also known as general

liability insurance, and provides coverage for bodily injury and property

damage (including other vessels) caused by your activities.

Marine insurance can be purchased by individuals, businesses

and associations. The coverage available varies by type of vessel, but

typically includes:

Comprehensive coverage – This provides comprehensive

protection for your vessel, cargo and crew against fire, theft and other

perils.

Liability – This provides coverage for bodily injury or

property damage to another person if you're at fault.

Collision – This provides coverage in case you hit another

vessel while underway. It also covers collision with dock walls or pilings when

docking at an anchorage.

How does it work?

Marine insurance is available to help protect you from the

financial consequences of damage or loss to your boat. It can be a useful tool

for protecting your assets, as well as your peace of mind.

How does it work?

Marine insurance covers you for losses arising from a wide

range of hazards that may affect the value of your boat. The types of insurance

cover available will depend on whether you own an insurable interest in a boat,

whether it is an un-insured vessel or just privately owned.

The type of marine insurance policy you'll need depends on

how much risk you want to take on with your investment and what level of cover

you require.

What does marine insurance cover?

Marine insurance can be a great way to protect your boat and

its contents. It provides coverage for loss or damage to your boat, as well as

any other property that's involved in an accident.

Most marine policies include:

Boat rental coverage: This pays for damages caused by a

covered person or company, such as a charter company or marina owner, when you

rent the boat from them. For example, if you rented a boat from the marina

where you live and someone slips and falls on the dock and damages it, this

would be covered under your marine insurance policy.

Excess Liability Coverage: This pays for any damages beyond

the limits of your boat insurance policy. If you have $100,000 worth of

liability coverage and someone slips and falls on the dock next door and

damages their house's roof — causing more than $100,000 worth of damage — then

this excess amount would be covered under your marine insurance policy.

Personal effects coverage: This covers personal belongings

that are inside your boat at the time it is damaged or destroyed (such as

clothing), along with other items that were left there by accident (like

tools).

How much does marine insurance cost?

Marine insurance is one of the most expensive types of

insurance. It protects your boat against damage and theft, but it may also

protect you from liability for legal action by others.

Marine insurance typically has a higher premium than other

types of coverage because it protects against so many things. If you have a

boat, it's likely that you're going to use it at least once or twice a year,

which means that you'll have to pay for an annual policy. If you have a fishing

boat, then there's even more risk involved because boats can get damaged or

stolen relatively easily depending on where they're located and who owns them.

A marine policy will cover everything from lost or damaged

equipment to lawsuits and other civil suits related to your boat. It will also

cover any claims made by passengers on board your vessel as well as any

third-party property damage or bodily injury claims made against you under

certain circumstances like collision or collisions with other boats while

driving recklessly in foggy weather conditions.

Who has to have it?

If you're a boat owner, you need to have marine insurance.

You should also be sure that your insurance policy covers all the risks of

owning a boat and use it properly, so you don't end up having to pay for other

people's messes.

Here are five reasons why it's important to have boat

insurance:

You could be sued for damages caused by your boat. If

someone is injured on your boat, you could be sued for damages.

Your boat could sink or catch fire and cause damage to other

boats or structures in a marina. This includes docks, piers and parking lots.

If a fire occurs on your boat, it could spread to another vessel or structure

in a marina.

Your family could be injured in an accident involving your

recreational watercraft (RWC). An RWC is any motorized device used for

recreation or sport that is propelled by an internal combustion engine powered

by fuel combusted within the engine. That includes jet skis, wakeboards,

personal watercraft (PWC), sailboats and more.

A person with whom you share ownership of an RWC may lose

control of the RWC during an auto accident and injure others who were riding

with them at the time of impact

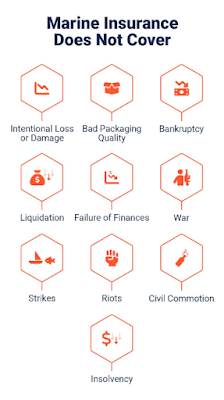

What is not covered?

The insurance that is covered by your state's requirements

and the coverage you purchase will vary. However, there are many ways your

policy can be affected by a marine insurance claim.

What's not covered?

The type of coverage you need depends on your specific

needs. For example, if you are boating in a high-risk environment, such as the

Gulf of Mexico or the Atlantic Ocean, you may want to purchase additional

marine insurance.

The following items and services are not covered under most

marine policies:

Personal injury claims

Property damage claims

Loss of use or pleasure of use of your boat

Boat rental charges, storage fees and hire charges unless

included in the policy (if included, these will be handled through the rental

company)

Legal costs for your defense against an opposing party's

claim (exceptions may apply)

Conclusion

Marine insurance is a niche market, and one worth exploring

carefully if you own a boat or other marine-based property. You don't want to

find yourself stuck in a sticky situation if your boat sinks on a weekend

getaway, but you also want to avoid overspending unnecessarily when you can

easily get the protection you need for much cheaper than your current insurance

firm. That's why it's so important that you educate yourself on the basics of

marine insurance before diving in.

You may like to read: 5 Tips for The Best Accident Insurance

0 Comments